Table of Contents

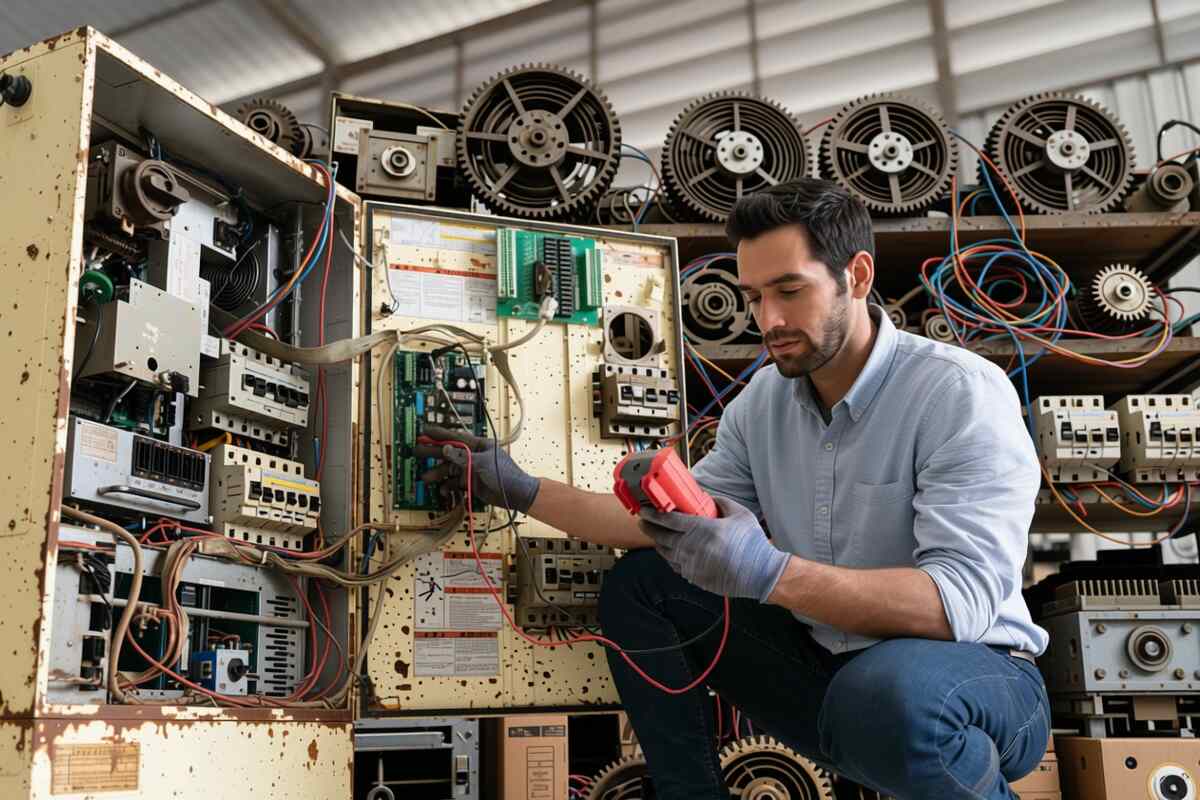

ToggleWalk into any industrial facility, and chances are you’ll find rows of unused electrical equipment—old switchgear stashed in a corner, spare transformers gathering dust, or control panels that haven’t been touched in years. These aren’t just forgotten parts. They’re hidden profits.

In today’s climate of tightening budgets, aging infrastructure, and increasing pressure to optimize operations, facility managers and plant leaders are being asked to do more with less. The irony? Many facilities are sitting on thousands—sometimes hundreds of thousands—of dollars in unused or underutilized electrical inventory without a plan to recover its value.

Industrial investment recovery is the strategy behind reclaiming that value. When done right, it turns surplus and idle electrical assets into capital that can be reinvested into operations, modernization, or even cost savings. But for electrical power and control components, recovery isn’t just about clearing shelves—it’s about maximizing safety, compliance, and long-term efficiency.

This guide is built specifically for facility managers, plant supervisors, and maintenance leaders who want to take a more proactive, strategic approach to managing their electrical inventory. We’ll walk through practical steps to identify recoverable assets, determine the best disposal or reuse options, and measure the real financial impact of a recovery program.

If you’ve ever looked around your warehouse and thought, “We should do something with all this,” this guide is your blueprint.

What Is Industrial Investment Recovery?

At its core, industrial investment recovery is the strategic process of reclaiming value from surplus, idle, obsolete, or unused assets—before they become dead weight on your balance sheet. Think of it as the flip side of procurement. While most facilities focus on acquiring what’s needed to operate, investment recovery focuses on what’s no longer needed—and how to turn it into something valuable again.

For facilities in the electrical power and control space, this often means dealing with components like circuit breakers, switchgear, panelboards, transformers, drives, and motor starters. Over time, these assets can accumulate due to upgrades, plant shutdowns, retrofits, or routine replacements. Left unmanaged, they drain warehouse space, complicate inventory systems, and pose potential safety or compliance risks.

But here’s the opportunity:

Those same unused components can often be resold, refurbished, repurposed, or responsibly recycled. Some may even be redeployed within your own facility or across your enterprise—delivering significant cost avoidance compared to buying new.

Investment recovery isn’t just about cleaning house. It’s about transforming inventory liabilities into financial and operational gains. When done right, it leads to:

- Cash generation through resale or liquidation

- Cost savings via internal redeployment

- Risk reduction by improving compliance and eliminating hazardous stockpiles

- Efficiency gains from a leaner, more accurate inventory

- Sustainability improvements, supporting corporate ESG goals

In essence, it’s an often-overlooked but powerful lever for boosting profitability—especially in capital-intensive environments where electrical infrastructure plays a central role.

The Hidden Profit Drain: Idle Electrical Equipment

Idle equipment doesn’t just take up space—it quietly chips away at your budget, productivity, and peace of mind. In industrial settings where margins are often razor-thin and uptime is king, every inch of wasted inventory is a missed financial opportunity.

The Real Cost of Unused Electrical Inventory

You might think, “It’s just sitting there—it’s not hurting anything.” But idle electrical gear carries real, often invisible, costs.

Let’s break them down:

- Carrying Costs:

Every item on a shelf costs you money to keep there—whether it’s a spare circuit breaker or a decommissioned VFD. These costs include storage, insurance, asset depreciation, and sometimes even taxes. The longer it sits, the less valuable it becomes, both financially and functionally. - Inventory Bloat and Inefficiency:

Bulky enclosures and hard-to-label electrical components create chaos in storerooms. Your team wastes time hunting for the right part, sometimes buying duplicates because they didn’t know what was already there. - Safety and Compliance Risk:

Electrical components degrade over time—especially in uncontrolled environments. Loose wiring, damaged insulation, and obsolete components can all create code violations or fire hazards. OSHA, NFPA 70E, and local regulations don’t look kindly on forgotten inventory piles. - Opportunity Cost of Space:

Industrial floor space is expensive real estate. Whether you’re paying to store obsolete transformers or shelving retired MCC buckets, you’re eating up square footage that could house productive equipment—or be downsized altogether. - Obsolescence and Scrap Value Loss:

The electrical industry evolves fast. By the time you finally remember that pallet of control panels, the models might be obsolete, unsupported by OEMs, or simply worth pennies on the dollar compared to what they could’ve fetched two years ago.

Why Electrical Equipment Is Particularly Problematic

Unlike large machines or visible capital assets, electrical components often fly under the radar. They aren’t always tracked in ERP systems. They’re labeled as “spares,” “emergency use,” or worse—“someone else’s problem.”

They sit quietly in:

- Locked electrical rooms

- Cages inside maintenance areas

- Forgotten pallets near loading docks

- Crates in off-site warehouses with no audit trail

This is particularly common during:

- System upgrades and plant retrofits

- Facility consolidations or relocations

- Preventive maintenance, where parts were replaced preemptively

And because they’re electrical, there’s often hesitation about how to properly test, certify, or resell them—so no one acts.

How Idle Inventory Adds Up — A Scenario

Let’s say your facility stores:

- 10 motor starters

- 6 switchgear units

- 4 industrial control panels

- 1 unused medium-voltage transformer

Stored for 3–5 years, with no clear plan for redeployment or sale. Based on average resale values and adjusted for condition, those assets could be worth $35,000 to $80,000 on the secondary market—or could provide equivalent value in cost avoidance if reused internally.

Instead, they sit. Untracked. Degrading. Taking up space. Slowly losing value.

Idle electrical inventory isn’t neutral—it’s actively costing you money, time, and opportunity. And the longer you wait, the harder it becomes to recoup that value.

Investment recovery gives you the framework to not only clean up your storage space, but also reintroduce hidden value into your operation—and your bottom line.

Strategic Framework for Maximizing Recovery Value

So you’ve identified idle electrical equipment gathering dust in your facility. Now what?

Most facilities reactively scrap or sell surplus parts without a system. But to truly maximize profit and minimize risk, you need a repeatable framework—one that turns equipment recovery from a headache into a strategic advantage.

This section breaks down the key steps in an effective industrial investment recovery process tailored to the electrical power & control environment.

1. Conduct a Full Electrical Inventory Audit

Start by figuring out exactly what you have. You can’t recover value from what you don’t know exists.

- Where to look: electrical rooms, backup parts closets, offsite storage, trailers, unused mezzanine space

- What to track: part type, voltage class, condition, OEM, serial number, installation date (if known)

- Pro tip: Use a mobile-enabled inventory tool or spreadsheet template with photos for easier resale or redeployment decisions

This step often uncovers surprising value—new-in-box parts, discontinued but in-demand models, or components still under warranty.

2. Assign Fair Market Value

Once cataloged, you’ll need to determine what each item is worth.

- Check resale platforms like eBay, PEARL, or industry-specific marketplaces

- Talk to surplus dealers or recovery specialists who can provide pricing based on market demand

- Don’t assume “old” means “worthless”—many legacy parts are in high demand due to long lead times or discontinued OEM lines

Also consider the internal value: what would it cost to buy this new? Redeploying internally could save you even more than resale.

3. Redeploy, Resell, or Recycle

Choose the right path for each asset based on condition, demand, and need.

Redeploy

- When compatible with current or planned projects

- Saves on procurement costs

- Ideal for facilities with multiple sites or locations

Resell

- When equipment is functional, in demand, and not needed internally

- Generates direct cash recovery

- Suited for newer, lightly used, or surplus gear

Recycle

- For broken, obsolete, or unsafe components

- Ensure proper environmental handling

- Use certified e-waste or metal recovery partners

Redeployment avoids procurement costs. Resale generates cash. Recycling should be the last resort—but must be done safely and compliantly.

4. Partner with the Right Recovery Experts

Investment recovery isn’t always a DIY job—especially for sensitive or high-voltage equipment.

Choose a partner that:

- Understands electrical equipment, not just scrap value

- Offers proper testing, certification, and chain-of-custody documentation

- Can handle transportation and environmental disposal where needed

- Has connections with the right resale channels (industrial buyers, auction houses, brokers)

The wrong partner might lowball your inventory or fail to follow compliance protocols, putting your facility at risk.

5. Choose the Right Disposition Channels

Where you sell matters. Consider the following:

- Industrial marketplaces (e.g., EquipNet, GovDeals, PEARL members)

- Online auctions for one-off or mixed lots

- Direct buyer networks for high-value or specialty equipment

- Certified recycling centers for unusable items, especially those with hazardous components

Each channel has pros and cons in terms of speed, exposure, and return on investment.

6. Track KPIs and Communicate Impact

Treat investment recovery like any other operational initiative—it deserves metrics.

Track:

- Value recovered ($)

- Internal cost avoidance (via redeployment)

- Warehouse space freed (sq. ft.)

- Inventory reduction (%)

- Environmental diversion (lbs recycled vs. landfilled)

Use these insights to build internal buy-in, justify future projects, or report on ESG goals.

Financial & Operational Benefits

Implementing a structured industrial investment recovery program isn’t just good housekeeping—it’s a strategic lever that improves your bottom line, streamlines operations, and supports long-term facility health. Below are the key financial and operational wins you can expect when you recover value from idle electrical assets.

Financial Benefits

1. Immediate Cash Recovery

- Reselling surplus or idle electrical equipment can generate tens—or even hundreds—of—thousands of dollars.

- Many industrial facilities sit on years of unclaimed capital without realizing it.

2. Cost Avoidance Through Redeployment

- Internal reuse of transformers, drives, or switchgear saves procurement costs.

- You avoid delays and budget approvals often tied to purchasing new components.

3. Reduced Carrying Costs

- Free up warehouse space, reduce insurance premiums, and avoid unnecessary environmental storage fees.

- Less clutter means lower risk and lower operational costs.

4. Improved Asset Turnover Ratios

- High-value inventory that sits for years hurts your asset utilization metrics.

- Investment recovery helps align your inventory with actual demand.

5. Higher ROI on Capital Equipment

- By recovering or redeploying parts from phased-out systems, you extend their lifecycle and ROI.

Operational Benefits

1. Smoother Maintenance & Emergency Response

- With a cleaner, streamlined inventory, your maintenance team can quickly find what they need.

- Faster repairs, fewer delays, and better uptime.

2. Enhanced Safety & Compliance

- Reducing outdated or unsafe equipment lowers the risk of code violations, fines, and injuries.

- Keeps you aligned with OSHA, NFPA, NEC, and local standards.

3. Increased Warehouse & Floor Space

- Clear out unused gear and reclaim valuable square footage.

- More room for active equipment, expansions, or even downsizing facility costs.

4. Stronger Cross-Departmental Visibility

- Procurement, maintenance, and finance all benefit from a transparent view of what assets exist and where they’re going.

- Cuts back on redundant orders and mismatched stocking practices.

5. Supports Lean & Sustainable Operations

- Reduces waste, supports 5S programs, and contributes to environmental performance goals.

- Every recovered asset is one less item ending up in a landfill.

Investment recovery generates real capital, frees up resources, and makes your operation leaner, safer, and smarter.

Pitfalls to Avoid in Investment Recovery

Even the best-intentioned recovery efforts can fall short without the right approach. Many facilities jump into investment recovery thinking it’s as simple as selling off extra inventory—but oversights, missteps, and poor planning often lead to lost value or increased risk.

Avoiding these common pitfalls can mean the difference between a one-time cleanup and a long-term profit stream.

Treating It as a One-Time Project

- Recovery isn’t a spring cleaning task—it should be part of your facility’s ongoing strategy.

- One-off efforts miss recurring opportunities that arise during shutdowns, upgrades, or relocations.

Fix: Build investment recovery into SOPs for decommissioning, inventory audits, and CAPEX planning.

Failing to Track or Value Assets Properly

- Many facilities toss surplus equipment without assessing market value.

- Items are often scrapped or stored indefinitely when they could be sold or reused.

Fix: Implement a basic asset tracking system. Even a spreadsheet with photos, condition notes, and estimated resale value is better than nothing.

Overlooking Internal Redeployment

- Teams often rush to sell, ignoring the cost-saving potential of reuse within the facility or sister sites.

- New purchases happen while usable assets sit idle.

Fix: Include operations, engineering, and procurement in asset evaluations. Ask, “Can we use this elsewhere before we sell?”

Choosing the Wrong Disposal Channels

- Partnering with general scrap dealers may yield minimal return.

- Some third-party firms focus on quick clearance, not asset value recovery.

Fix: Work with specialists in electrical equipment recovery who understand your assets and have resale networks in your industry.

Ignoring Safety, Compliance, or Data Risks

- Some electrical equipment contains hazardous materials or requires proper certification before resale.

- Improper disposal can lead to fines, liability, or reputation damage.

Fix: Ensure equipment is tested, documented, and handled according to NFPA, OSHA, and environmental standards. Maintain a chain of custody.

Skipping Post-Recovery Reporting

- Without reporting, leadership can’t see the value of the effort—and the program fizzles.

- Teams miss the opportunity to measure ROI or promote sustainability achievements.

Fix: Track KPIs like dollars recovered, space freed, and landfill diversion. Share results with finance, operations, and ESG teams.

Summary: Recovery Done Wrong Costs You

When investment recovery is rushed, disconnected, or treated like an afterthought, it can create:

- Missed revenue

- Unnecessary downtime

- Redundant purchasing

- Compliance headaches

With planning and the right partnerships, these missteps are entirely avoidable—and recovery becomes a repeatable win.

Real-World Scenario: Unlocking $85,000 in Hidden Value

Sometimes the best way to understand the impact of investment recovery is to see it in action. Here’s a fictionalized—but realistic—example based on trends and conversations with facility managers across the industrial sector.

The Situation: Overflowing Electrical Inventory

A mid-sized manufacturing plant in Indiana was preparing for a partial facility renovation and equipment upgrade. The plant had been in operation for over 30 years, and over time, its electrical inventory had quietly grown out of control.

Stored in wire cages, dusty back rooms, and off-site containers were:

- 12 unused switchgear units

- 3 transformers (one still in its original crate)

- Dozens of motor starters, circuit breakers, and control panels

- Spare VFDs from a discontinued conveyor system

No one had touched the inventory in over five years. Some parts were still usable. Others were obsolete. The team just didn’t know what was valuable—or where to start.

The Approach: Implementing a Simple Recovery Process

Rather than scrap everything during the renovation, the facility manager decided to take a more strategic route:

- Conducted a detailed inventory audit using a simple spreadsheet and smartphone photos

- Partnered with an electrical asset recovery specialist to assess the value of equipment

- Tagged items for internal redeployment, resale, or recycling

- Used online marketplaces and a regional buyer network to move high-demand gear

- Tracked everything through a shared dashboard with plant leadership

The Outcome: From Clutter to Capital

In just eight weeks, the facility recovered:

- $47,000 from the resale of functioning equipment

- $38,000 in cost savings by redeploying transformers and motor controls internally

- 1,500 square feet of warehouse space for more strategic use

- Full removal of outdated, non-compliant components in line with safety standards

They also documented results and presented a post-project report to the executive team, showing:

- Improved inventory accuracy

- Increased procurement visibility

- Positive impact on sustainability reporting

The plant had no idea it was sitting on that much value—because no one was looking.

This is the power of industrial investment recovery. When electrical equipment is treated as a strategic asset instead of dead weight, it becomes a source of profit, flexibility, and operational clarity.

Conclusion

In every industrial facility, there are forgotten assets—surplus electrical equipment quietly gathering dust and draining value from your operation. Whether it’s legacy switchgear, outdated motor controls, or unused transformers from past upgrades, these components represent more than clutter—they’re missed opportunities.

Industrial investment recovery is your opportunity to take control of that hidden inventory, turning it into working capital, operational efficiency, and measurable impact. It’s not just about getting rid of old parts. It’s about making smarter use of what you already own, avoiding unnecessary purchases, reducing carrying costs, and supporting your facility’s safety and sustainability goals.

At Electrical Power and Control, we make it easy to take the first step. If you’re ready to clear your shelves and reclaim your capital, we want to hear from you. We buy surplus and used electrical equipment from facilities just like yours—quickly, fairly, and with expert support at every step. Visit our sell to us page to get started today.

Let us help you unlock the value that’s been hiding in your storeroom all along.